There has been considerable speculation about how the OBBB will impact energy, and we speak with Steve Everley and Dan Goodwin of FTI Consulting. They bring the receipts and the research on the impact.

No surprise that Natural Gas was the big winner, but how much thought has gone into the grid, reliability, and the growth path is critical. The United States experienced stagnant electric demand for decades, and now we are facing rapid demand growth. This was also predicted by FTI Consultants in their various models and combined data sets.

Below is the demand before the OBBB, and the grey represents the impact after all changes were made through the House and Senate. You can see the huge increase in natural gas.

“If the incremental growth provided by the bill were a state, it would be a top 10 state in size.” - Steve Everley”

Highlights of the Podcast

00:01 – Introductions and Overview

02:18 – FTI Consulting Roles and Background

05:10 – Modeling the Energy Impacts

08:50 – Natural Gas as a Big Winner

10:39 – Supply Chain Constraints

16:38 – Rise of Microgrids and Behind-the-Meter Power

19:31 – Wind and Solar Take a Hit

26:56 – Nuclear Outlook

29:19 – Battery Storage Growth

31:30 – Challenges with Battery and Solar Supply Chains

34:54 – Natural Gas: From ‘Bridge Fuel’ to Cornerstone

39:30 – Future Outlook and Closing Thoughts

Nuclear Gets A Boost

On the podcast, I was able to ask about how nuclear energy plays into the OBBB. They are not planning for modular reactors to substantially impact the grid until after 2030, and the funding appears to be for the larger plants. They are looking for this to change as technology and reactors get approved. We also discussed the importance of microgrids and the shift towards decentralized management as renewable energy sources potentially decline.

Renewables Get Slashed

The renewable decline is showing both wind and solar, but if solar were shown separately, it would be a steeper decline. Wind is not as shut down as solar.

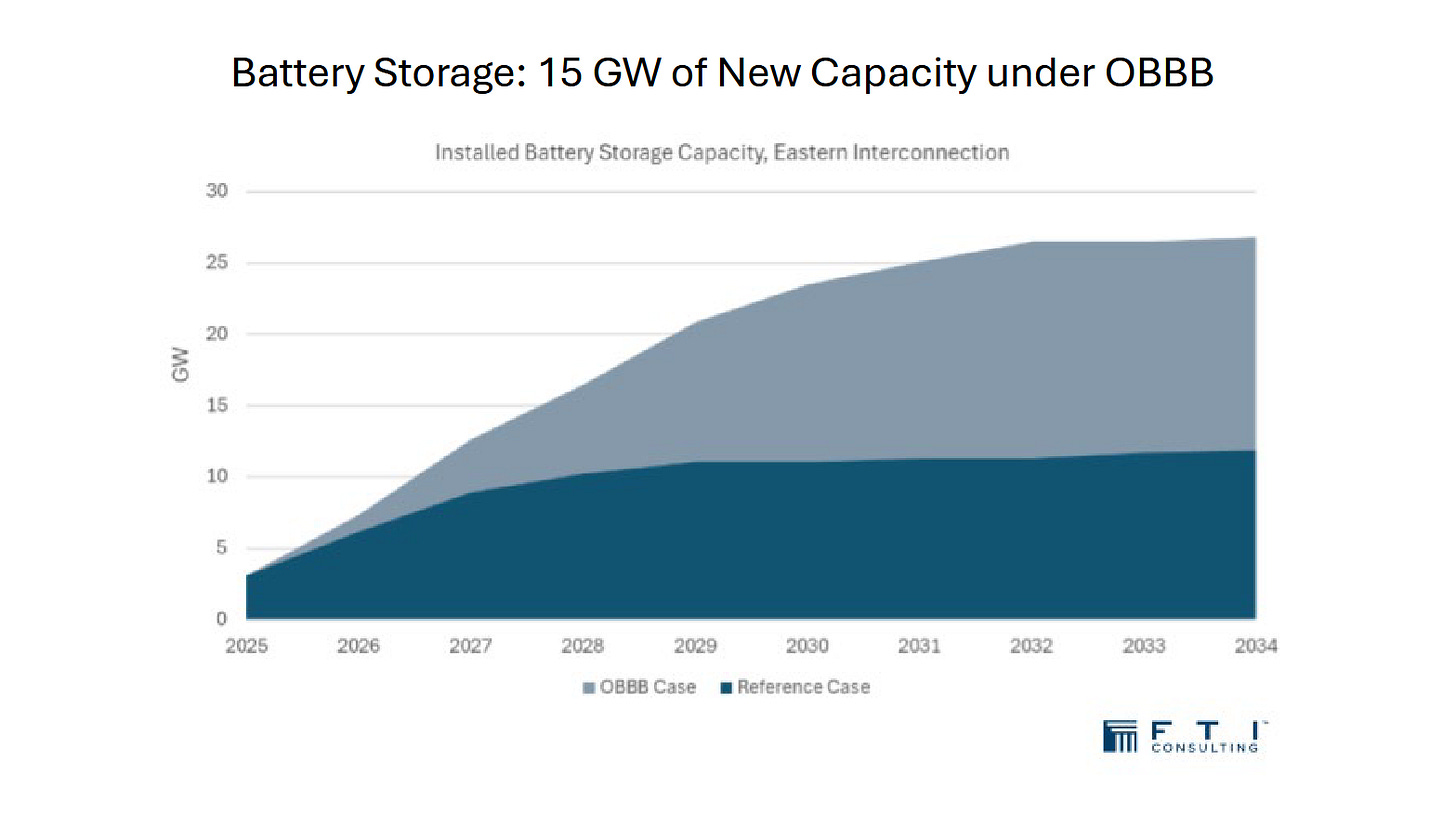

Storage is a Winner

This growth in storage is intended to support the already installed base for wind and solar. This raises some significant questions about how much help storage will provide in stabilizing the grid.

The U.S. Department of Energy’s new report, which addresses grid reliability, is also crucial to this discussion. DOE’s Grid Reliability Report Sounds the Alarm: Opportunities for Investors in a Strained Energy Landscape

Key Points

The Department of Energy’s (DOE) report, released on July 7, 2025, highlights significant grid reliability risks by 2030 due to surging demand from AI data centers and manufacturing, with potential blackouts expected to increase 100-fold.

It seems likely that companies providing firm, dispatchable power (like coal, natural gas, and nuclear) and those innovating in grid modernization will benefit, given the report’s emphasis on reliability.

Research suggests investors should consider firms like Peabody Energy, Constellation Energy, NextEra Energy, Vistra Corp, and GE Vernova, based on their alignment with the report’s findings, though outcomes depend on policy shifts.

We highly recommend following Steve and Dan on their LinkedIn accounts here.

Steve Everly:https://www.linkedin.com/in/steveeverley/

Dan Goodwin: https://www.linkedin.com/in/dangoodwin-fti/

While there was not nearly enough cut out of government in the Big Beautiful Bill, it did help set the stage for change, and we can move forward. With our great leadership in Energy, we stand to have a great opportunity to achieve Energy Dominance. The Department of Energy, Interior, and the EPA have their work cut out for them.

Tomorrow at 11:00, the Doomberg, Mike Umbro, and David Blackmon’s episode about California’s drain on National Security rolls out. And this helps set the stage.

Share this post