We have been covering the problems that Oil and Gas companies face in an overregulated UK, where they are overtaxed and would be better off leaving the country. We saw Shell move before over taxes and regulations, it would make sense that they leave the left-leaning UK's horrible business environment.

The story in New York follows along, and it does not make sense to spend billions of dollars on “renewable” when you have hydro, nuclear, and natural gas. However, under the current leadership in New York, there is no ability to meet the growing electricity demand.

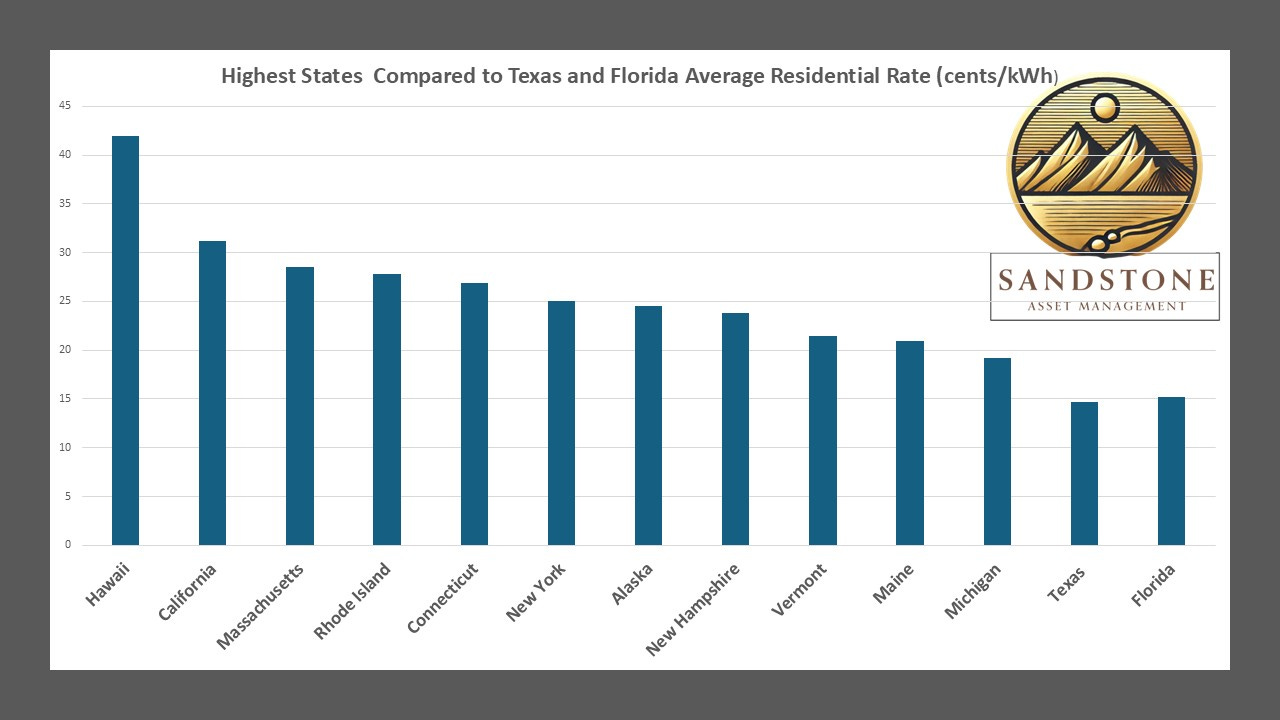

Compare the most expensive electricity states to Texas and Florida.

Daily Standup Top Stories

Alberta Spends $5 Million to Support World’s First Direct Air Carbon Capture Centre

Would Trees Be Cheaper? = Don’t want to spoil the article, but YES.

China’s EV Market is in turmoil

China’s EV market is quite fascinating, and some of their products are equipped with cool features; however, their predatory practices, which contribute to trade imbalances in export markets, are taking a toll on the EV […]

New York Power Grid Stabilizes After Rare Energy Warning: Energy Mix, Renewable Challenges, and Cost Comparisons

On June 24, 2025, New York’s power grid faced a critical test as temperatures soared to 99°F in Central Park, pushing electricity demand to precarious levels. The New York Independent System Operator (NYISO) issued a […]

US Crude Inventories Hit 11-Year Seasonal Low, Yet Stocks Fall Amid Strong Summer Driving Demand

U.S. crude oil inventories have dropped to an 11-year seasonal low, driven by robust summer driving demand, yet oil stocks are paradoxically declining. The U.S. Energy Information Administration (EIA) reported an 11.5 million barrel drawdown […]

Shell’s Potential Acquisition of BP: A Game-Changing Oil Megamerger?

The energy sector is buzzing with speculation following an exclusive report from The Wall Street Journal, which revealed that Shell (NYSE:SHEL) is in early-stage talks to acquire its British rival BP (NYSE:BP). This potential $80 […]

Highlights of the Podcast

00:00 – Intro

01:07 – Alberta Spends $5 Million to Support World’s First Direct Air Carbon Capture Centre

03:21 – China’s EV Market is in turmoil

06:24 – New York Power Grid Stabilizes After Rare Energy Warning: Energy Mix, Renewable Challenges, and Cost Comparisons

11:11 – Markets Update

12:13 – US Crude Inventories Hit 11-Year Seasonal Low, Yet Stocks Fall Amid Strong Summer Driving Demand

12:29 – Shell’s Potential Acquisition of BP: A Game-Changing Oil Megamerger?

15:57 – Outro

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

Need Power For Your Data Center, Hospital, or Business?

https://energynewsbeat.co/investment-survey/

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:00] BP spurned at the altar next on the energy news beat daily stand-up. [00:00:04][4.1]

Michael Tanner: [00:00:12] What’s going on everybody? Welcome into the Thursday, June 26th, 2025 edition of the Daily Energy Newsbeat standup. Here are today’s top headlines. First up, direct from the Energy News Beat substack, Alberta spends $5 million to support the world’s largest direct air carbon capture center. Really, really fascinating. Next China’s EV market is in turmoil. Finally, New York. Power grid stabilizes after rare energy warning, energy mix, renewables, challenges, and cost comparisons. Stu will then toss it to me. I will quickly cover what happened in the oil and gas market to crude oil inventories hit an 11-year low. And then, finally, a very interesting Wall Street general report. Shell on the brink of acquiring BP? Well, not so fast. And we will cover all that in a bag of chips, guys. As always, I’m Michael Tanner joined by Stuart Turley. Where do you want to begin? [00:01:06][54.4]

Stuart Turley: [00:01:07] Hey, let’s start with our buddies up there in Alberta. Holy smokes, Alberta spends $5.5 million to support the world’s first direct air carbon capture center. Alberta is making headlines with a $5 million investment from its Technology Innovations Emissions Reduction Tier Fund to support what’s being billed as the world first direct air, carbon capture DAC. Innovation Commercialization Center. Holy smokes. Okay, so I asked, I went out and I took a look and I said, wait a minute, for how many? For this much money, for $5 million, Michael, how many trees do you think it would take in order to actually do the same job? Oh gosh, I would say about 100,000 trees. No, we’re talking maybe about a thousand. Let me get to this place in here. It is not very much. The Deep Sky Center is a bold experiment, but $5,000,000 price tag and high operational costs makes it a tough compared to planting trees. Which would achieve similar CO2 removal for under $150,000. And I even got the formula in here on how many trees per how many tons of CO2 it would remove. This is absolutely nuts. So why would you want to spend $5 million versus 150,000? It doesn’t make sense. [00:02:27][80.5]

Michael Tanner: [00:02:28] No, it makes absolutely no sense. I mean, what’s interesting is, is that Alberta is generally considered that the Texas and the Florida of Canada, now the Texas and Florida of Canada is still somewhere in between New York city and New Jersey. It’s probably along the line, but they are, we do love our friends in Alberta. I’m very fascinated about why they’re doing [00:02:51][22.7]

Stuart Turley: [00:02:51] Oh, absolutely. And I absolutely love putting this out on our substack, but I, it, a lot has to do with the carbon tax carbon credit scheme that is going back to the head country, head Cabanos over there in the Eastern part of Canada, the leadership, because they’re using this fund as a slush fund to pay for the school bus programs that failed, you know, the ones that Kamala really liked. Yes. The wheels on the bus go round and round. Yeah. Speaking of Kamala,. [00:03:20][29.3]

Stuart Turley: [00:03:21] Let’s go to China. China’s EV market is in turmoil. Holy smokes, Batman. I had a lot of fun writing this article. Michael key points research. This is from Peter St on Jones. He’s a D that I follow on X. He is one cool cat besides having my hairline. He is absolutely spot on. And so I took his information and I had an old article that I wrote around it. Research suggests China’s car industry, especially EVs facing severe downturn with about 400 of the 500 EV companies failing, RUTRO export data from 2025 is limited. So what I did is I went and got the 2024 data and took a look at it. Chery, I never heard of this car at all, had sold 1.1 million exports in 2024. BYD, I’ve heard of and they’re great. Their cars are cool. They’ve got some really cool features in them, 440,000. But here’s the thing. The implosion of China’s car industry, particularly EVs is a complex issue with significant domestic and international ramifications. The problem is they bomb out a market with really low prices, wipe out all their competition and have these predatory prices, and then nobody wants to do business with China. So we have the EU, Canada, and the UK looking to do business with china and have their car companies move over and do weaponization and creating in the military regime. And putting their car manufacturers and moving them to their military stuff because of all the military spending that they’ve got to do, we’re seeing some nutty things go on in the energy space around cars. I did not have any of that on my bingo card. [00:05:20][118.6]

Michael Tanner: [00:05:20] Yeah, it’s, I think the interesting part is that this price war is not just, you know, I think people think, oh, it just to do with the tariffs that the United States imposed. No, I mean, Europe has imposed a 38% tariff on all Chinese EVs. And you can really are now starting to see who the imposters are. I love that the comment that Peter Ansog said, he calls it the Lehman Brothers moment for China, which I think is hilarious. You know, I think the two companies from my perspective that I see making it through this one is BYD. I think, you know, from a, from a full self-driving standpoint, from a value standpoint, they will probably make it out of this. And then obviously Tesla has a strong presence in China. And I’m, I’m we’re both bullish Tesla. So I have a strong reason to believe they will probably make it out. [00:06:10][50.2]

Stuart Turley: [00:06:11] Oh, you bet. And, and in fact, I, I believe Tesla and I’ve, I know some folks that are day trading Tesla and making a lot of money. So anyway, let’s go to the next story here. We do not give advice, investing advice on this show, just throw that out. Let’s go to New York power grid stabilizes after rare energy warning, energy mix, renewable challenges and cost comparisons. I actually saw the original story on this Michael on zero edge. And I love Tyler Durham. He does a great job over there. So I took that and I went and looked up a lot of other information in there. And then while I was writing this, Doug Burgum showed up on the mornings with Maria show. And on this very warm morning, it’s only 2% of the power from the PJM grid was coming from wind and solar 98% from other sources. So New York is 44% natural gas, 22% hydro, 22%, nuclear, 4% wind, 3% solar biomass and others. So, I mean, you sit back and take a look at this. How can a state absolutely not want pipelines? I don’t get what they’re doing. Now I took it one step further. Michael, I compared electricity costs of New York versus the other top 10, but I threw in Texas and Florida, and you can see that Texas is about half of Hawaii and we’re pretty close to California. Let’s see, let’s, it is, where’s New York, New York. New York. 25 cents per kilowatt and Texas is about 15. [00:07:53][102.4]

Michael Tanner: [00:07:54] Yeah. And I think it has to do a lot with the deregulated grid here, which I actually know I may or may not be in favor of. I do also think, I think, it’s interesting. You, you talked about that energy mix in New York. I mean, it’s 44% natural gas, it’s 22% hydroelectric, and 22% nuclear, so I mean you’re talking everything else is, that only leaves about 7% for wind and solar, I mean the funny part is you would think about how much they whine and complain about the environment in New York, those number would go up. [00:08:24][30.4]

Stuart Turley: [00:08:24] But they’ve got hydro. They’ve got natural gas. They don’t have any coal. They’re doing that right from actually are they are I’m not but they’re their taxes and their fees to the consumer and they’re they’re grafting and every all their other policies that’s what gets them into that California range. [00:08:43][18.6]

Michael Tanner: [00:08:44] And after the latest New York City Democratic primary, I mean, real estate is about to get real cheap there. [00:08:48][4.6]

Stuart Turley: [00:08:49] Oh my goodness, we’re going to see a mass exodus out of New York. Holy smokes. They are idiots. I think we ought to check the machines. That’s just me. [00:09:02][13.3]

Michael Tanner: [00:09:03] Okay. All right. Well, let’s jump over here and quickly talk oil and gas finance guys. Before we do that, let us pay the bills real quick. As always, thank you for checking us out energynewsbeat.com, the world’s greatest website. You hit, go ahead and hit the links in the description below, all timestamps and a great way to just stay in contact with the show. Also check us out on sub stack, the energy newsbeat.substack.com. We post a lot of great articles and content that you can only get there. I’m in the process of writing a great article for our paid only subscribers next week. And we will be recording early next week, our monthly state of the union for energy, but that’s going to be available only to our paid subscribers. So highly recommend you consider subscribing for a paid subscription. We’re also working on some other interesting stuff for those paid subs. So please great way to support the show, sign up for a paid subscription, theenergynewsbeat.substack.com. Thank you to Reese energy consulting for supporting the show guys. If you are at all needing help in the midstream space, whether you’re an upstream company who needs a marketing company, or you’re a mid-scene company that needs any sort of work, we love, love, love Reese Energy Consulting and our friends over there. Whether you’re two guys in their garage or the largest publicly traded companies, they work with everybody and have clients ranging in that range. Again, reeseenergyconsulting.com, Tell Energy Newsbeat sends you. Next, if you need help with data centers or you need Getting power to your office, to your data center, go to our landing page. Link will be in the description below, or go to our website and, and, and hit the link in any of the articles. We’ve run in a great, great, great, uh, special on getting you hooked up with natural gas generators. So if you need power and you need natural gas generation, we have the thing for you. And finally, guys, if you are interested in investing in oil and gas, check out our oil and gassed a portfolio survey. It’s a great way to figure out if oil and gas is right for you. And if it is right, for you, we’ll give you a bunch of resources on what to consider and consider pointing you in the right direction. That’s invest in oil.energynewsbeat.com. [00:11:09][126.1]

Michael Tanner: [00:11:11] Let’s look at top line indices, though, Stu. S&P 500 basically flat for the day. NASDAQ was only up about 2 tenths of a percentage point. Two-year yields dropped by one full percentage point, 10-year year yields were actually flat. Dollar index down about 2-tenths of percentage point Bitcoin up over $107,000. That was up about 1.2 percentage points. Crude oil, 65.18, or up about half a percentage point. Brent oil, fairly flat on the day, 67.86. Natural gas is actually up about 7. It was down at then in this later, it was down then in his latest trading session is up a little bit. It’s sitting at about $3.58. I mean, I think the big thing that drove pricing today was was mainly the, the stability of what could be a ceasefire between Iran and Israel. I know, you know, President Trump was freaking out two days ago about the, the non ceasefire that happened after they both agreed to the ceasefire. It seems like there’s going to be some calmness there, which I think you’re seeing the geopolitical risk get taken out of. You know, we,. [00:12:13][61.8]

Michael Tanner: [00:12:13] We did see crude oil inventories come in and dropped by about 5.8 million barrels on top of an 11 million barrel build or draw last year, which was. Or last week, which basically puts, as we see in our next article here, guys, puts us at an 11-year seasonal low, and we continue, continue to draw stocks from there. So I mean, Stu, you ran this article a little bit. Talk to me a little about what you’re seeing with the crude oil inventory trends and where this scares you, because I mean I did not know this. You know, we’re at an 11 year low on crude oil inventories. [00:12:46][32.9]

Stuart Turley: [00:12:47] I didn’t see it either on my bingo card, Michael. And when I sat there and I ran through this article and ran the numbers, it was 2014 was the last time that it was this low again. And when you take a look at that, normally the pattern is, and I got an idea from Josh Young in order to write this article. And so that when I saw his post, normally you’ll see And then the cool graphic there from Sandstone Asset Management. When you take a look at the graphic in there, the highlights of the anomaly of 2025 with inventories lower than all years except 2022. 418 million barrels in a drawdown that far exceeds the previous mid-July, June-like years, 2020 and 23. So why are stocks falling was one of the big questions that I asked it. So you’ve got the OPEC plus growth going on that they tried to go in. They let all of them say, Hey, go forth and pump oil. They didn’t get very far. Declining US shale. There has been the big discussion on US shales. Have we reached peak Permian yet? So what have we reach peak Permia? One. Basin or one play or does not make a country’s oil output. We’ve already discovered about 15 different other places in the country this year that have huge oil. So it just means Midland might lose a little bit of a steam or get a little bit more balance of less expensive housing anyway. [00:14:21][94.8]

Michael Tanner: [00:14:22] Yeah, no, completely agree. I think it’s this drawdown has been super fascinating. Last thing I want to cover is a very interesting, we’ve been talking about the Shell BP merger. It gets leaked this morning in the Wall Street Journal. They run a massive exclusive M&A on the horizon. Shell in advance talks to buy BP, and about 30 minutes later, Shell comes out and says emphatically, no we are not, and they don’t know who the anonymous sources was in the story. You know, generally… Wall Street Journal gets it right. And generally, you don’t see this type of reaction from when a M&A is leaked. So the fact that Shell came out super strong says they’re still in the either early, early phases, or this is just flat-out lying. Maybe it’s BP leaking this to try to drum up business from other suitors. If people think Shell’s in the game, then it maybe drives their price up from their other suitor. So there’s a bunch of different reasons for it. But otherwise, I didn’t really see anything else interesting in the news today, Stu. So we’re going to let everybody. Finish up who we have tomorrow on the podcast. [00:15:25][62.3]

Stuart Turley: [00:15:25] Um, we have Wasif Lata rolling out and this is going to be really exciting. Wasif is absolutely, he is the CEO over there at Samaria partners and I thoroughly enjoy every one of my podcasts with him because he is a wealth of investment knowledge in the commodity space. That man knows what he’s doing. [00:15:46][21.0]

Michael Tanner: [00:15:47] I absolutely, absolutely love Wasp. So really, really appreciate him coming on. That’ll be great. Saturday, you’ll hear the weekly recap. We’ll take Sunday off and be back in the chair on Monday, guys. So with that, we’re going to let you get out of here, finish up your week. Appreciate you guys checking us out. World’s greatest energy show, The Daily Energy Standup for Stuart Turley, I’m Michael Tanner. We’ll see you Saturday, folks. [00:15:47][0.0][927.9]

Share this post