What Is the Real Story of the Chinese Economy?

Trump's Tariffs exposed the Chinese weakness - an economy of exports and not local demand.

The narrative surrounding China’s economy is often one of unstoppable growth and global dominance, but a closer look reveals cracks beneath the surface. From structural weaknesses exposed by U.S. tariffs to overcapacity in refining and a collapsing automotive sector, China faces significant challenges. Meanwhile, emerging trade alignments involving the United States, Saudi Arabia, India, and Russia are reshaping the global economic order, potentially diminishing the relevance of BRICS. Let’s unpack the real story of the Chinese economy, with a focus on its vulnerabilities, energy strategies, and the shifting geopolitical landscape.

A Fragile Giant: China’s Economic Vulnerabilities

China’s economy, the world’s second-largest, has long been a powerhouse of manufacturing and exports. However, structural issues—such as excessive debt, a property bubble, and weak domestic consumption—threaten its stability. Posts on X, like one from

, highlight these weaknesses, noting that China’s significant debt and underwhelming domestic demand create a shaky foundation. The property crisis, which began in 2021, has led to widespread bankruptcies and a collapse in construction, once a major driver of growth. To offset this, Beijing has redirected cheap loans to exporters and manufacturers, a move that has propped up industrial output but deepened overcapacity in sectors like steel, solar panels, and refining.The specter of financial collapse looms large. Investment bank Nomura has warned that the ongoing U.S.-China trade war could cost China up to 16 million jobs, with industries like furniture, toys, and textiles already struggling to avoid bankruptcies. China’s central bank has responded with monetary stimulus, but analysts doubt its ability to address deeper structural issues. The economy’s reliance on exports makes it vulnerable to external shocks, particularly U.S. tariffs, which have exposed these frailties in stark relief.

Trump Tariffs: A Catalyst for Crisis

Since 2018, the U.S.-China trade war, escalated by President Donald Trump’s tariffs, has been a significant stressor for China’s economy. By April 2025, U.S. tariffs on Chinese goods reached a staggering 145%, prompting China to retaliate with 125% tariffs on U.S. imports. These levies have made trade between the world’s two largest economies nearly unfeasible, disrupting supply chains and halting cargo shipments from China to the U.S.

The tariffs have hit Chinese exporters hard, wiping out profit margins and forcing companies to seek alternative markets. For example, China has redirected goods to Southeast Asia, Europe, and Latin America, flooding these regions with cheap products. However, developing nations cannot fully replace the U.S. market, leading to factory closures and job losses in China’s industrial heartland. The tariffs have also restricted China’s access to critical U.S. technology, exacerbating challenges in advanced manufacturing sectors like semiconductors and electric vehicles (EVs).

China’s response has included export controls on rare earth minerals and magnets, critical for U.S. defense and clean energy industries. This move underscores China’s leverage in global supply chains but also highlights its desperation to counter U.S. pressure. A temporary truce in May 2025 reduced U.S. tariffs to 30% and Chinese tariffs to 10% for 90 days, but uncertainty persists, leaving businesses on both sides in limbo. The tariffs have not only strained China’s export-driven model but also exposed its overreliance on foreign markets, pushing Beijing to prioritize domestic consumption—a transition it has struggled to achieve.

Downstream Refining: A Double-Edged Sword

China’s energy sector offers another lens into its economic strategy. To counter declining domestic demand and leverage its industrial capacity, China has significantly increased downstream refining capacity. This allows the country to process crude oil into gasoline, diesel, and other fuels for export. According to industry reports, China’s refining capacity reached 18.7 million barrels per day in 2024, with plans for further expansion. This overcapacity has positioned China to target markets like California, where stringent environmental regulations create demand for specific fuel blends.

California, a major consumer of gasoline and diesel, imports significant volumes of refined products. China’s state-owned refiners, such as Sinopec and PetroChina, have capitalized on this by producing low-sulfur fuels that meet California’s standards. However, this strategy is fraught with risks. The U.S.-China trade war has reduced China’s oil imports from the U.S. by 90%, shifting reliance to Canada and other suppliers. Additionally, global oil prices, with WTI Crude falling to $60 per barrel in April 2025, have squeezed refining margins, making exports less profitable

China’s refining boom also contributes to global oversupply, depressing prices and hurting U.S. producers. For California consumers, increased reliance on Chinese fuels could raise prices if tariffs persist, as seen with potential gasoline price hikes of 5-20 cents per gallon in the Midwest due to tariffs on Canadian oil. While China’s refining strategy aims to offset domestic economic woes, it risks further entanglement in the trade war and exposure to volatile global energy markets.

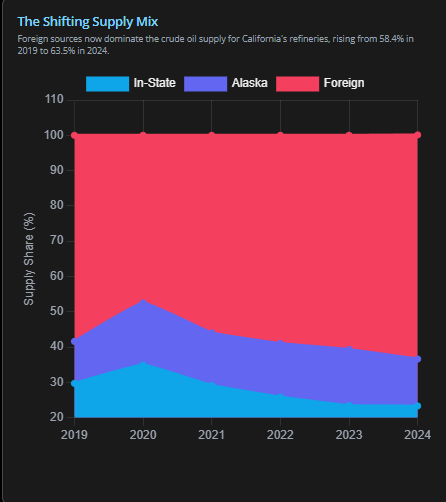

Just released this morning on Energy News Beat relating to the California and Chinese imports.

The research chart again highlights the National Security risk that California has become.California is a U.S. National Security Risk, and the Gas and Diesel Crisis Was Manufactured

Car Manufacturing Collapse: A Symptom of Deeper Issues

China’s automotive sector, once a symbol of its industrial prowess, is in crisis. The combination of Trump tariffs, domestic oversupply, and global competition has led to a collapse in car manufacturing. Chinese EV makers, heavily subsidized under the “Made in China 2025” initiative, face restricted access to the U.S. market, where tariffs have effectively blocked their exports. Domestically, a glut of vehicles—exacerbated by weak consumer demand—has led to price wars and shrinking profit margins.

The impact is evident in factory closures and job losses. For example, Ford Motor temporarily closed a Chicago plant in May 2025 after a supplier ran out of Chinese rare-earth magnets, which are critical for EV production. This incident highlights China’s control over supply chains but also its vulnerability to retaliatory U.S. restrictions. Chinese automakers have shifted production to Southeast Asia to bypass U.S. tariffs, but this “China-plus-one” strategy is costly and time-intensive, offering little immediate relief.

The collapse of the car manufacturing industry is a symptom of broader economic challenges, including overinvestment in industrial capacity, reliance on exports, and exposure to trade disruptions. As Chinese EVs flood markets like Brazil, local industries face pressure, illustrating the global ripple effects of China’s economic struggles.

As I reported on Energy News Beat, “China’s EV Market is in turmoil.”

The implosion of China’s car industry, particularly EVs, is a complex issue with significant domestic and international ramifications. The failure of numerous companies has left customers without support, while the oversupply is driving global trade tensions. Although 2025 export data is not yet available, the 2024 figures indicate continued export growth, with significant impacts on markets such as Europe and Brazil. This situation may lead to a “Lehman moment” for China, as suggested in the X post, with potential ripple effects on global industries.

New Trading Blocs: A Challenge to BRICS

The global economic landscape is shifting, with new trading blocs emerging that could marginalize BRICS (Brazil, Russia, India, China, South Africa). The United States is forging closer ties with Saudi Arabia, India, and Russia, driven by strategic and economic imperatives. These alignments threaten to reshape trade flows and reduce China’s influence. In my opinion, we will see trading opportunities emerge with Russia within the next six months, which will be beneficial for the United States and detrimental to China.

United States and Saudi Arabia: The U.S. is leveraging its energy dominance to strengthen ties with Saudi Arabia, a key OPEC member. Saudi Arabia’s increased oil supply in April 2025, partly to appease Trump’s calls for lower prices, underscores this partnership. This move counters China’s energy influence, as Saudi Arabia remains a critical supplier to Asia.

India’s Rise: India, a major consumer of Russian oil, is emerging as a pivotal player. U.S. tariffs on Chinese goods have pushed India to diversify its trade partners, aligning closer with the U.S. and Saudi Arabia. India’s growing economy and strategic position in the Indo-Pacific make it a counterweight to China.

Russia’s Pivot: Despite its BRICS membership, Russia is deepening ties with the U.S. to secure peace in Ukraine and counter Chinese dominance. Proposed U.S. sanctions, including 500% tariffs on countries buying Russian oil, pressure China and India but also signal Russia’s willingness to negotiate with the West.

These alignments challenge BRICS’ cohesion. China’s economic struggles and assertive trade policies have strained relations with other members. For instance, Brazil benefits from Chinese EV imports but seeks U.S. investment to become a manufacturing hub. Russia and India, meanwhile, prioritize their own strategic interests over BRICS solidarity. As the U.S. and its partners form a new economic bloc focused on energy, technology, and security, BRICS’ relevance as a counterweight to Western dominance wanes. China’s inability to rally BRICS against U.S. tariffs, as seen in its outreach to the EU and ASEAN, further underscores this shift.

Conclusion: A Turning Point for China and the World

The real story of the Chinese economy is one of resilience marred by vulnerability. Trump’s tariffs have exposed structural weaknesses, including debt, overcapacity, and reliance on exports. The collapse of car manufacturing and the push to export refined fuels to markets like California reflect China’s struggle to adapt. Meanwhile, new trading blocs involving the U.S., Saudi Arabia, India, and Russia are reshaping global trade, potentially sidelining BRICS.

For energy markets, China’s refining strategy and the U.S.-led trade realignments signal higher volatility. Consumers in California and beyond may face price hikes, while producers grapple with oversupply and tariffs. As Mike Umbro has said on the podcast, that gasoline in California (potentially imported from China) could start at $10 a gallon, and that ripple effect across the U.S. would hamper U.S. Energy Dominance. The Chinese financial story is closely tied to the California energy crisis, possibly more so than is publicly acknowledged.

California is a U.S. National Security Risk, and the Gas and Diesel Crisis Was Manufactured

The Chinese economy is at a crossroads, and its ability to navigate these challenges will shape not only its future but also the global energy and economic landscape. Will they sucker Canada, the UK, and the EU into taking their manufacturing jobs away, like the United States did over the last 50 years? If so, they will survive for a little longer, but a wolf in the corner will bite at anyone, even those trying to help. And that means starting a war, like taking Taiwan, to hide how bad things are from their citizens.

Stay tuned to Energy News Beat for the latest updates on this unfolding story.

Thank you, Stu for this article. I wonder how much Sinopec spends lobbying California to stimulate demand for the unique gasoline blends being demanded by Sacramento? (Those California-specific gasoline blends offer limited benefits in reducing California air pollution.)

Dear True Stu, Another good article stating the many things going down for China.Could not happen to a worse country HA! They have been the push behind the climate cons solar and wind.They have been paying allot of people behind our backs to push for of the so called Renewables that are not "renewable" at all.Looks like they are suppose to be "renewable" for China, to pump more money into their pockets and out of ours.