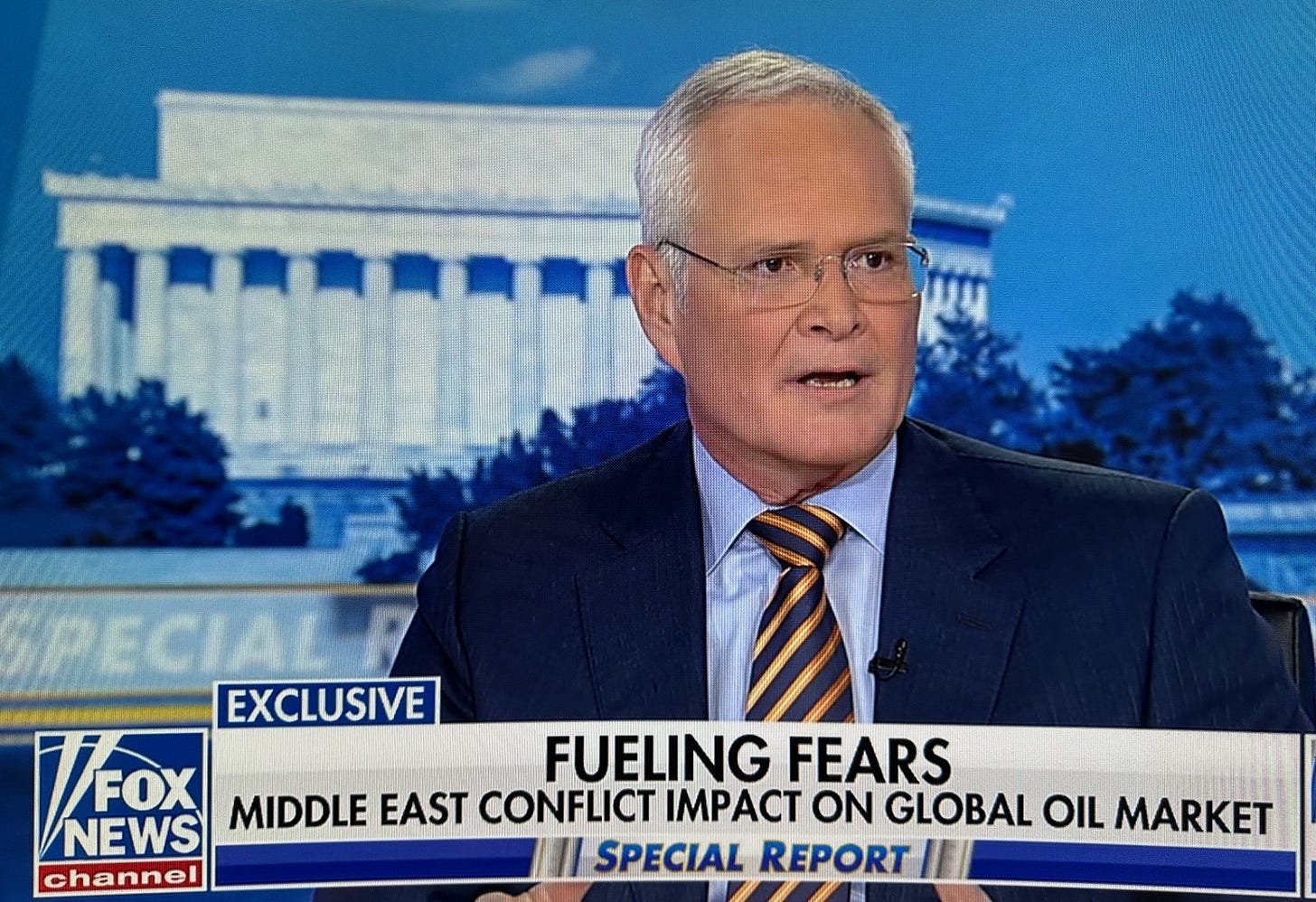

Darren Woods, CEO, ExxonMobil on Fox brings his perspective to the current Israel/Iran conflict.

We have not reached peak oil demand, and need congress to act now to hold the European Union's "corporate sustainability due diligence directive" at bay.

In this key discussion with Darrin Woods, CEO, ExxonMobil, and Bret Baier on Fox, it was an excellent exchange on global energy, regulations, and the issue of the Israel-Iran war going on. The full transcript is provided below, following the bullet points.

One of the key questions from Bret was very critical around the European Union’s rules on Carbon C…

Keep reading with a 7-day free trial

Subscribe to Energy News Beat to keep reading this post and get 7 days of free access to the full post archives.