Can President Trump Take Control of the California Refineries to Stop a National Security Crisis?

What would the policial fall out be?

In the face of escalating energy challenges, California finds itself at a crossroads. The planned closure of two major oil refineries—Phillips 66's Wilmington facility and Valero's Benicia plant—threatens to slash the state's refining capacity by approximately 17%, exacerbating fuel price volatility and deepening reliance on foreign imports.

We have an interview with Doomberg scheduled for release this Friday, and we will cover the California National Security crisis.

These shutdowns, set for late 2025 and April 2026, respectively, come amid stringent state regulations aimed at accelerating a shift to electric vehicles (EVs). Still, critics argue they pose a dire national security risk by undermining U.S. energy independence.

With California already importing about 70% of its crude oil, the closures could drive gasoline prices to $8 per gallon or higher, while increasing vulnerability to global supply disruptions. Mike Umbro on the podcast expected it to start at $8 and expand from there.

This situation raises a pressing question: Can President Trump leverage federal powers to intervene, halt the closures, and redirect oil supplies toward domestic sources like Alaska?

The Refinery Crisis: A Perfect Storm of Regulation and Risk

California's refinery woes stem from a combination of aggressive climate policies and economic pressures. The California Air Resources Board (CARB) has imposed regulations that effectively raise gasoline prices to incentivize EV adoption. Still, these measures have backfired by prompting refinery operators to exit the market.

Phillips 66's 139,000-barrel-per-day (b/d) Wilmington refinery and Valero's 145,000 b/d Benicia facility represent a significant chunk of the state's capacity, with their closures following earlier shutdowns like Phillips 66’s Rodeo and Marathon’s Martinez plants.

As of mid-2025, these moves have heightened concerns over supply shortages, with fuel imports hitting a four-year high amid outages and longer shipping times from Asia.

The impacts are multifaceted. West Coast gasoline prices, already elevated compared to the national average, are projected to rise modestly in 2026 due to reduced capacity, though lower crude prices might provide some relief.

More alarmingly, the shift toward imports—from sources like Saudi Arabia, Ecuador, and potentially China or India—raises pollution concerns and national security vulnerabilities. We also covered the Russian oil that was sent to India, refined, and then sent to California.

California's military installations, reliant on jet fuel and diesel, could face disruptions, turning a state-level policy into a federal headache.

Political backlash has intensified, with lawmakers calling for CARB resignations and questioning the state's role in engineering this "hot potato."

Federal Powers: From War Powers to Emergency Declarations

President Trump has signaled a proactive stance on energy, declaring a National Energy Emergency on January 20, 2025, to unleash domestic production and remove regulatory barriers.

This declaration empowers agencies to invoke emergency authorities for energy supply, potentially overriding state impediments.

But can he specifically halt refinery closures?

The War Powers Resolution of 1973, often cited in discussions of presidential authority, primarily limits the president's ability to engage in military conflicts without congressional approval and does not directly extend to domestic economic controls.

Historical precedents, like the Second War Powers Act of 1942, allowed resource allocation during WWII but expired post-war.

Instead, the Defense Production Act (DPA) of 1950 emerges as a more fitting tool. Enacted during the Korean War and reauthorized multiple times, the DPA grants the president broad powers to prioritize contracts, allocate materials, and expand industrial capacity for national defense.

Under the DPA, the president could deem refinery operations essential for national security—particularly given energy's role in military readiness—and order continued production or even seize facilities if necessary.

Past invocations include Trump's use for COVID-19 supplies and Biden's for clean energy materials.

In the context of California's closures, which could lead to 20% capacity loss and heightened import dependence, Trump could argue that preventing shutdowns safeguards against a "national security crisis."

Additional authorities under the National Emergencies Act and the Energy Policy and Conservation Act could complement this, allowing for strategic petroleum reserve drawdowns or broader economic interventions.

Trump's April 2025 executive order, "Protecting American Energy From State Overreach," further bolsters this by committing to remove "illegitimate impediments" to energy development, potentially preempting California's regulations.

Legal experts note that while the DPA focuses on expansion rather than outright prevention of closures, its allocation powers could be interpreted broadly in an emergency to maintain critical infrastructure.

Forcing Domestic Oil Purchases: The Alaska Angle

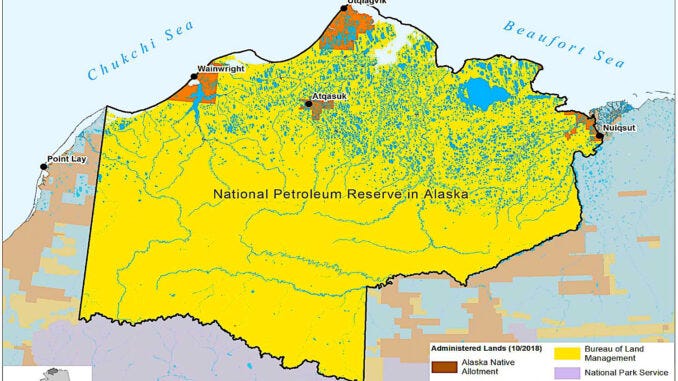

Redirecting California's oil imports toward Alaska presents another layer of complexity. Alaska's North Slope produces around 461,000 b/d, with proven reserves of 3.6 billion barrels, yet its Trans-Alaska Pipeline operates at just 25% capacity.

Critics of CNBC's low business ranking for Alaska argue it overlooks the state's potential to supply domestic markets, potentially generating $30 billion annually by feeding California's 1.2 million b/d import needs and reducing reliance on foreign sources.

Can the federal government mandate this? Direct coercion of states to buy from specific domestic sources is limited by the Commerce Clause, which empowers Congress to regulate interstate trade but respects state autonomy.

However, in emergencies, the DPA's allocation authority allows the president to control the flow of critical materials, potentially prioritizing Alaskan oil for West Coast refineries.

The Jones Act, which raises shipping costs for domestic oil, complicates economics but doesn't prohibit federal incentives or mandates.

Trump's energy emergency declaration and orders like "Unleashing Alaska's Extraordinary Resource Potential" emphasize expanding Alaskan production for national benefit.

While outright forcing purchases might face legal challenges, federal subsidies, export restrictions on Alaskan oil, or emergency allocations could effectively steer supplies domestically

Historical quotas on oil imports and production demonstrate precedent for federal intervention in supply chains.

Conclusion: A Path Forward or Legal Battleground?

President Trump possesses robust tools under the DPA, national emergency declarations, and targeted executive orders to potentially halt California's refinery closures and promote Alaskan oil as a secure alternative. Framing the issue as a national security imperative—amid risks of $10 gasoline, military fuel shortages, and foreign dependence—strengthens his case.

California has purchased oil, gasoline, and diesel from countries despite sanctions. It does not seem to care that they are doing more harm to the environment in the name of Net Zero and Energy Hypocrisy.

Yet, such actions could spark lawsuits over federal overreach into state affairs. As California grapples with its self-inflicted energy crunch, federal intervention might not only avert a crisis but also signal a broader push for American energy dominance.

The ball is in Trump's court—will he seize the refineries to secure the nation's future?

What do you think?

Just some articles I have written on California in the last two weeks. Stay tuned for the Doomberg, Mike Umbro, and David Blackmon podcast on Friday.

Below figures need to be updated for 2023-24 but they probably haven't changed much, and the figures show the significant oil potential remaining ⁸in California. However, it's near impossible to get the drilling permits to develop these resources.

How much proven oil remains? As of December 31, 2022, California's proven crude oil reserves were approximately 1.492 billion barrels (BBO), accounting for about 3.1% of the United States' total crude oil reserves (EIA, CEC). Official 2023-2024 figures are not yet available, however, it is estimated that ~ 217 million barrels of crude oil (MMBO) was produced up to November 30, 2024 and remaining proven reserves are ~ 1.3 BBO, as no sizable proven reserves have been added in the last several years (subject to revision by on-going assessments).

How much oil is undiscovered? The USGS estimated undiscovered oil in the key onshore areas while the (BOEM) estimated the offshore. The estimated mean volume of undiscovered oil in the San Joaquin basin is 393 MMBO, the Ventura basin is 250 MMBO, and the Los Angeles basin is 1,400 MMBO. The estimated offshore mean is 250 MMBO. The combined onshore and offshore mean volume is 2,293 MMBO and the high estimate is 3,802 MMBO. Undiscovered estimates do not include untested unconventional Monterey shale and west-side San Joaquin basin fold and thrust plays.

Thomas L. Davis PhD

California Professional Geologist #4171

Ventura, CA 93001

USA

https://thomasldavisgeologist.com/

Can’t wait for Friday. After that discussion, the next step will be the solutions. Firstly, why the hell does California have its own emissions standards etc. That is BS imo.