Are Microgrids and power sources only for those who can afford them?

The global push to renewables has caused a new problem.

Doug Sheridan on LinkedIn has a great post today. He is bringing some huge issues to light. I want to build upon his discussion and add some key points below.

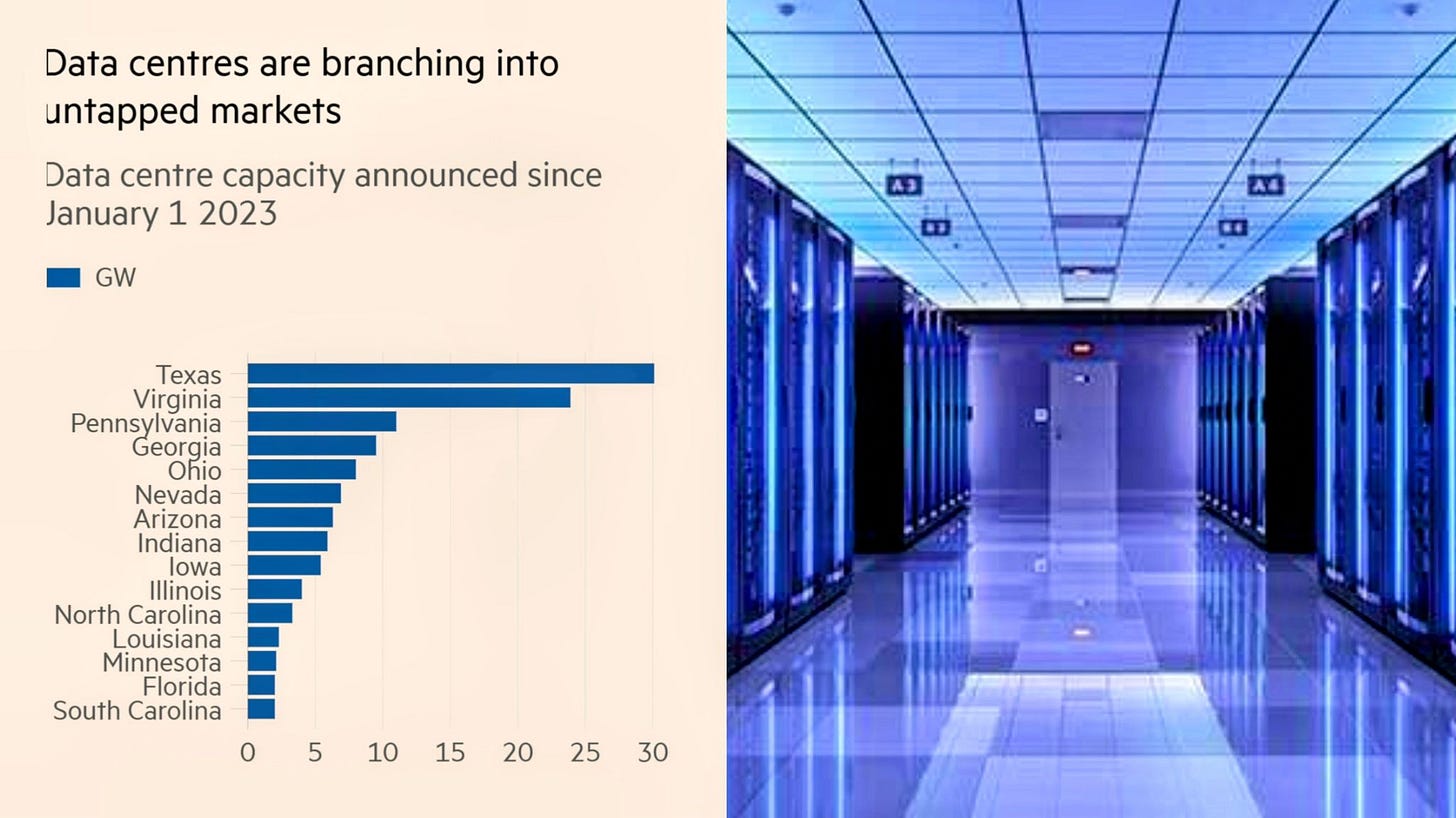

The FT writes, interconnection queues are bursting at the seams in the US, as tech companies tussle to hook power-hungry data centers up to grids across the country. But if data centers are onboar…

Keep reading with a 7-day free trial

Subscribe to Energy News Beat to keep reading this post and get 7 days of free access to the full post archives.